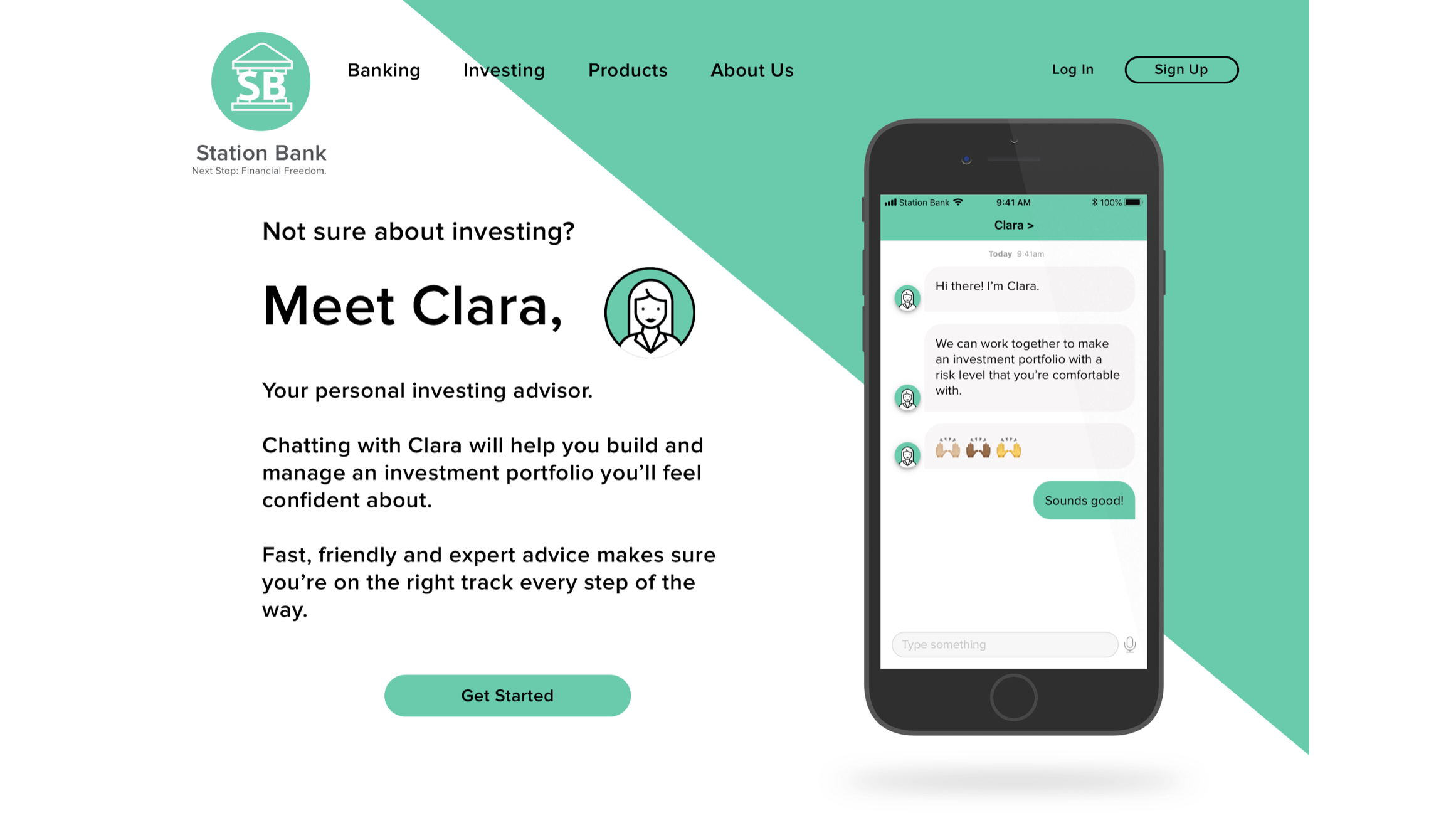

CLARA @

STATION BANK

CLARA

CONTENTS

Research

Ideation

The Solution

Personas

How It Works

Final Thoughts

CONTENTS

Research

Ideation

The Solution

Personas

How It Works

Final Thoughts

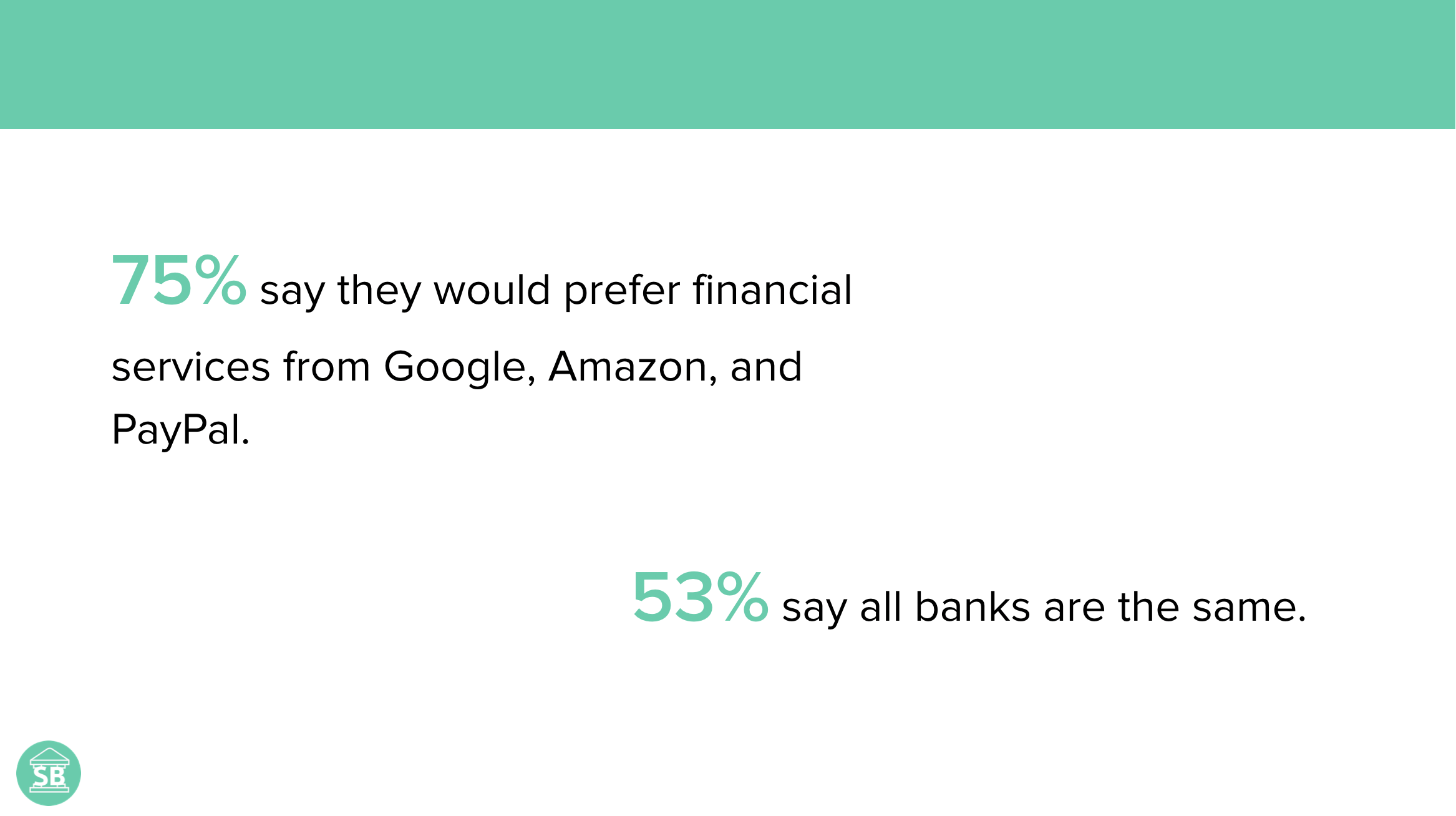

Millennials do not connect with traditional banks.

- 75% prefer financial services from tech companies

- 1/3 are ready to switch banks in the nex 90 days

- 53% believe all banks are the same

- 71% of millenials would rather go the dentist than speak with a financial advisor

Clara the Virtual Assistant, was created working with a team of four on a one week design sprint. Clara was created a digital solution in order to attract young professionals to invest by helping millenials become comfortable and feel more confident about investing.

- 1 week Sprint, Feb 2019

- Role: Research, UX Designer

- Tools: Sketch, Invision

RESEARCH

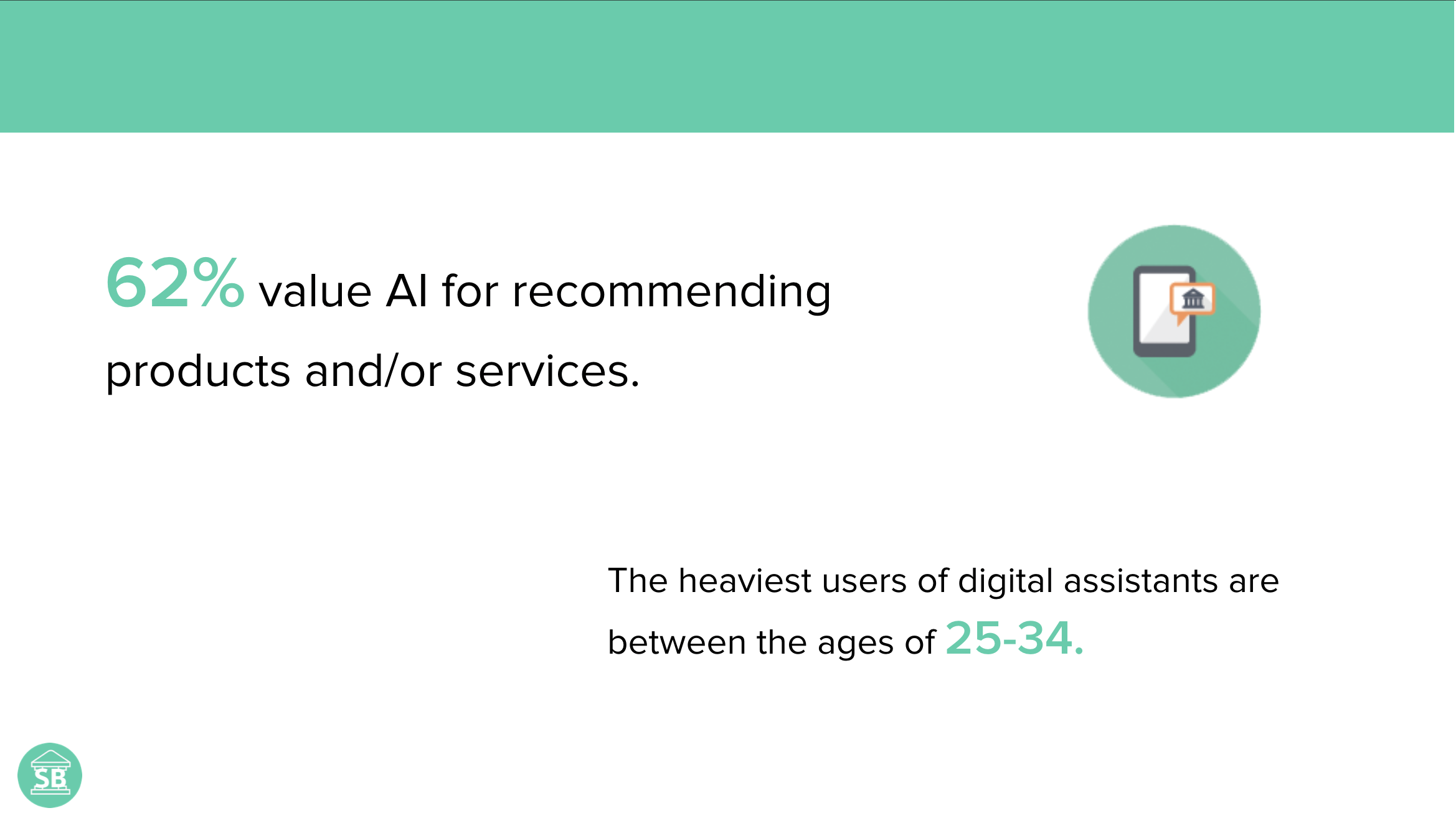

Secondary research online revealed the following:

In-person an telephone interviews supported the following insights about millenials:

- Do majority of banking online

- Have some disposable income and clear financial goals

- Are interested in investing but don't know where to start and think its risky

- Would seek advice from a knowledgeable friend rather than bank

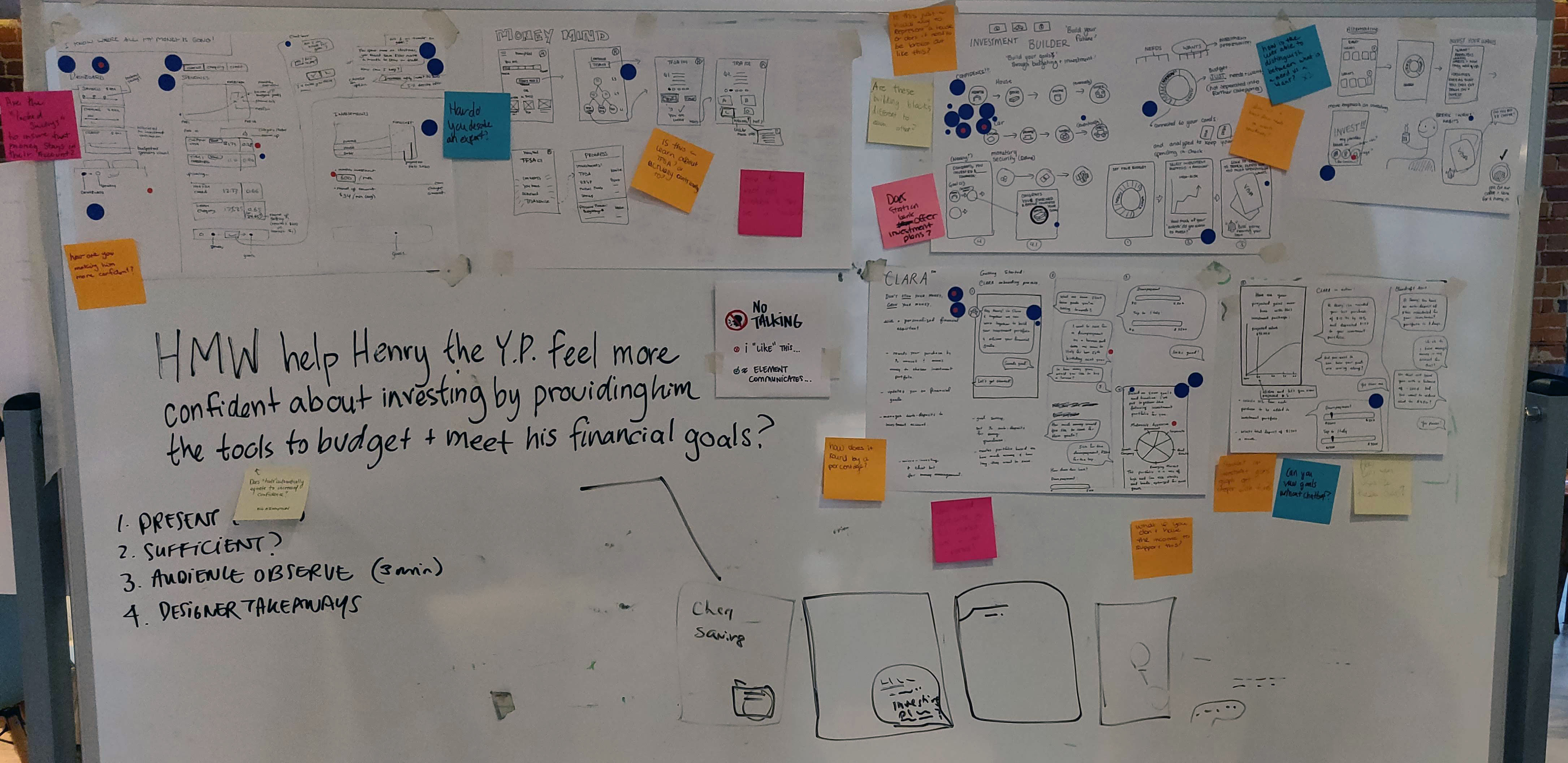

How might we help young professionals

feel more confident about investing to

meet their financial goals?

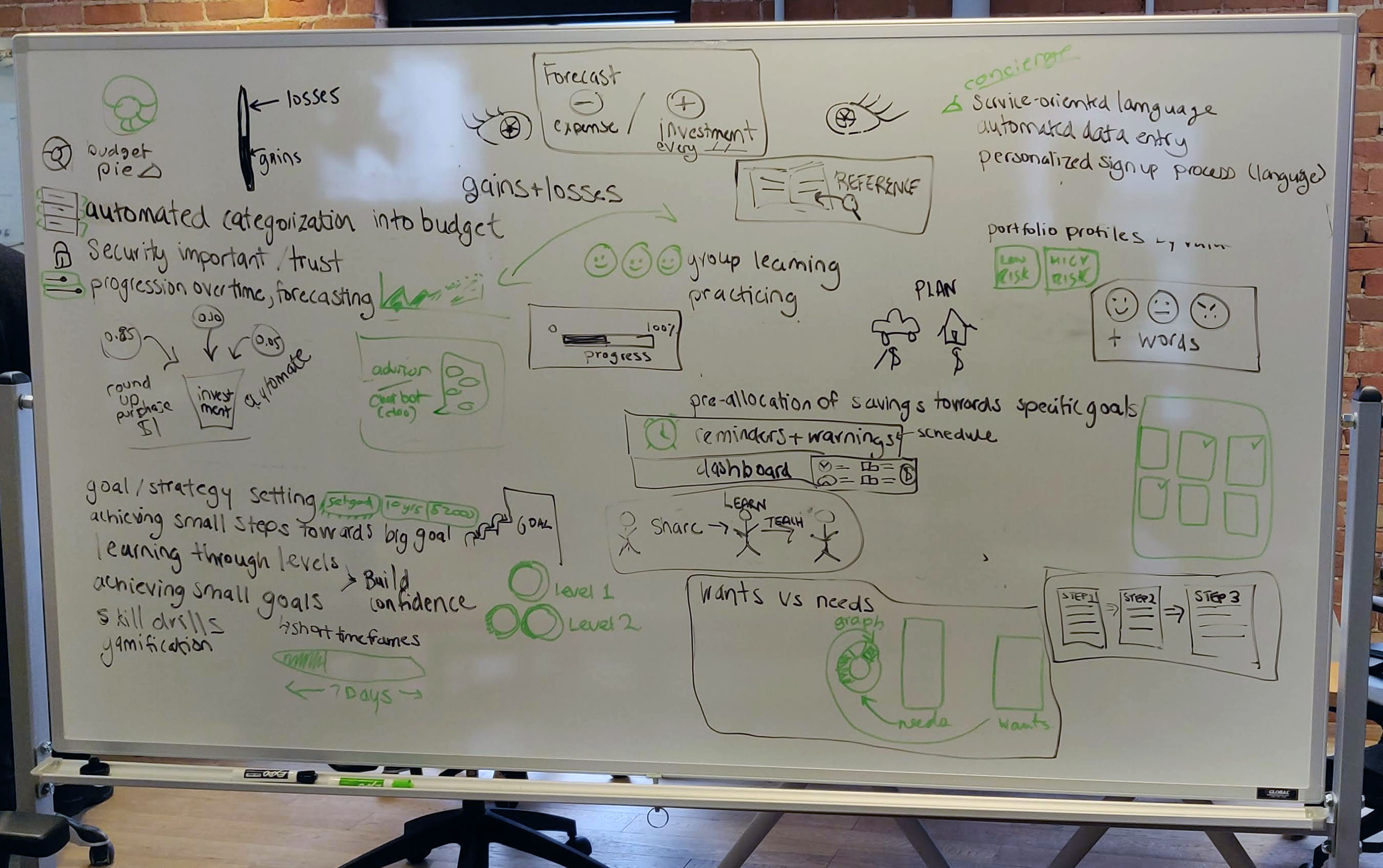

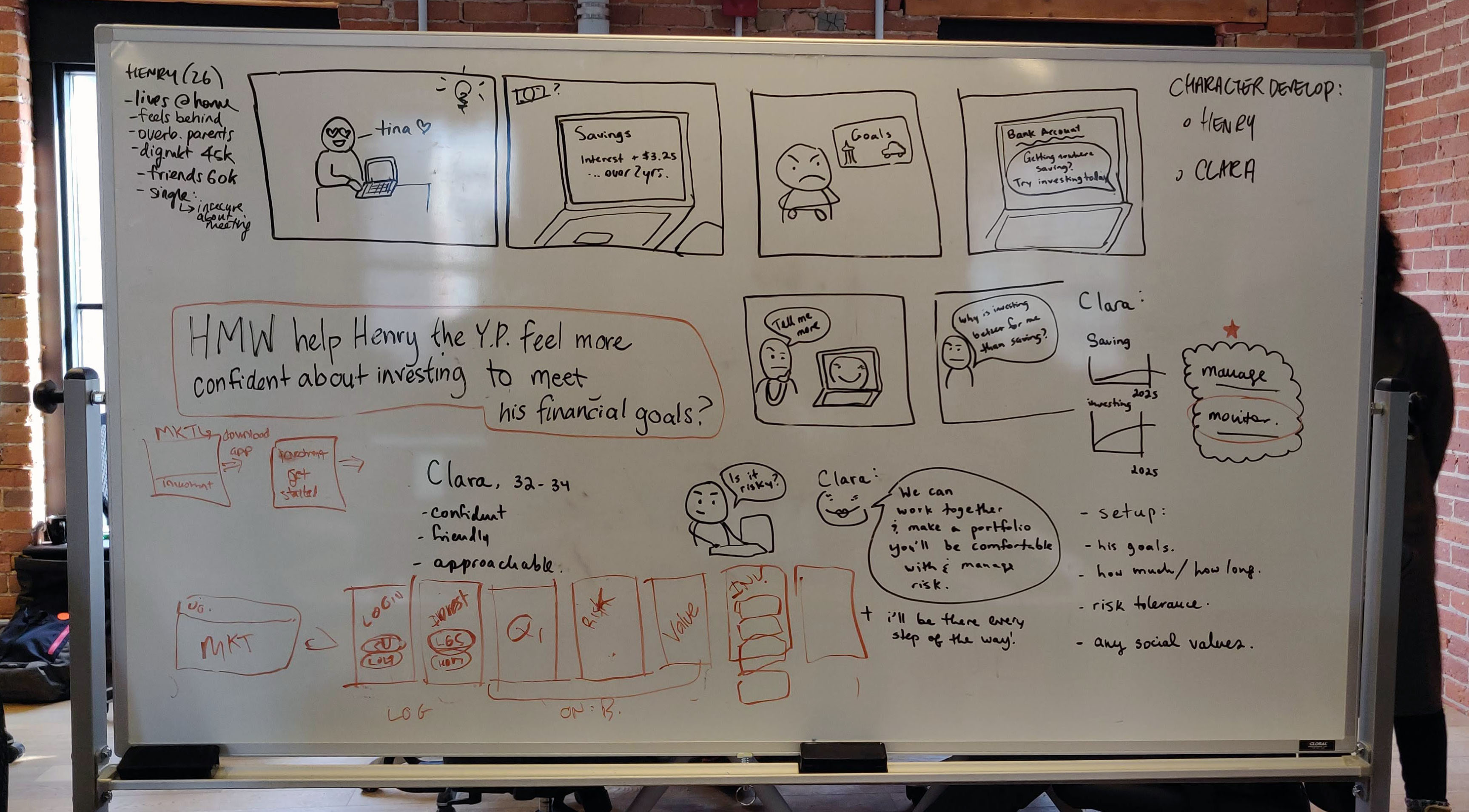

IDEATION

With the problem in mind, we searched online for inspiration and compiled the ideas onto a whiteboard for further review and reference.

Using crazy eights we drafted our best concepts and using a silent gallery stroll, voted on the ideas and concepts for prototyping.

THE SOLUTION

PERSONAS

Henry

Digital Marketing Specialist

- Lives at home

- Contributes to savings monthly

- Has disposable income

- Goals: Wants to purchase a condo within 5 years

"I keep saving and saving but I feel like I'm not getting anywhere."

Clara

Investment Chatbot

- Warm, empathetic, responsive, and responsible

- Breaks down complex ideas and problems

- Goals: To help build confidence and knowledge in investing

"Everyone has the potential to achieve their goals. Nothing satisfies me more than helping people fulfill their dreams through financial planning."

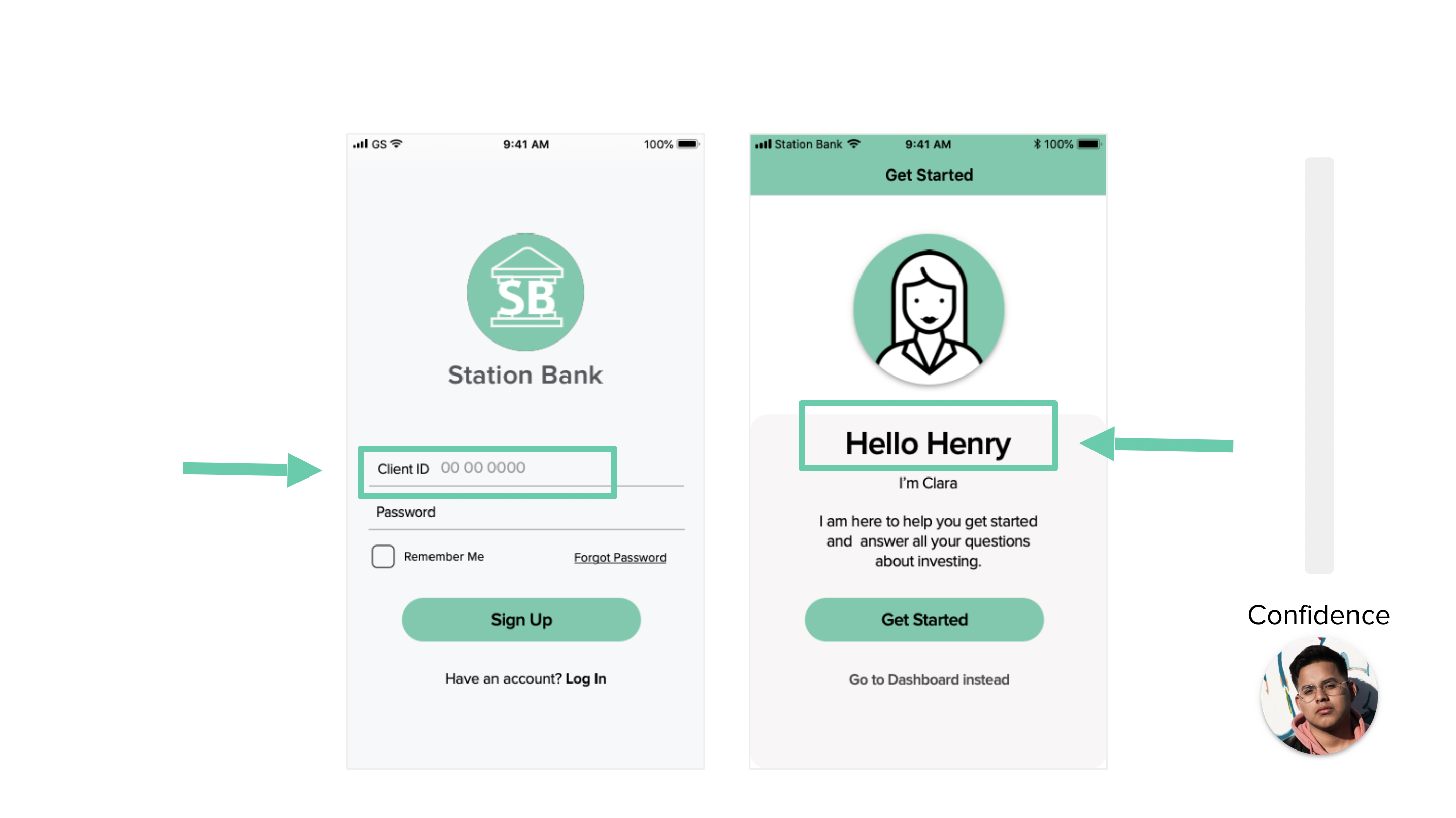

HOW IT WORKS

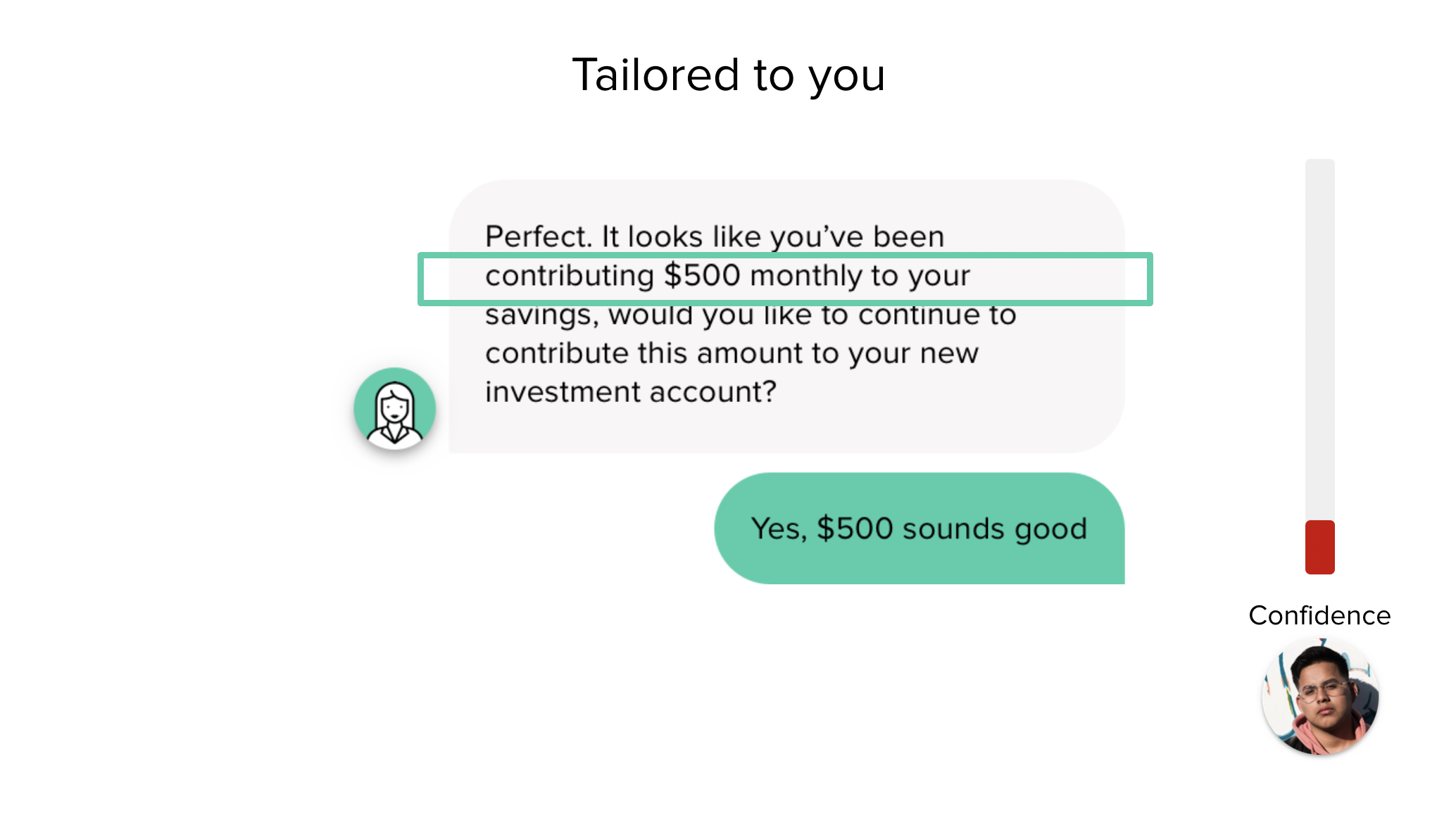

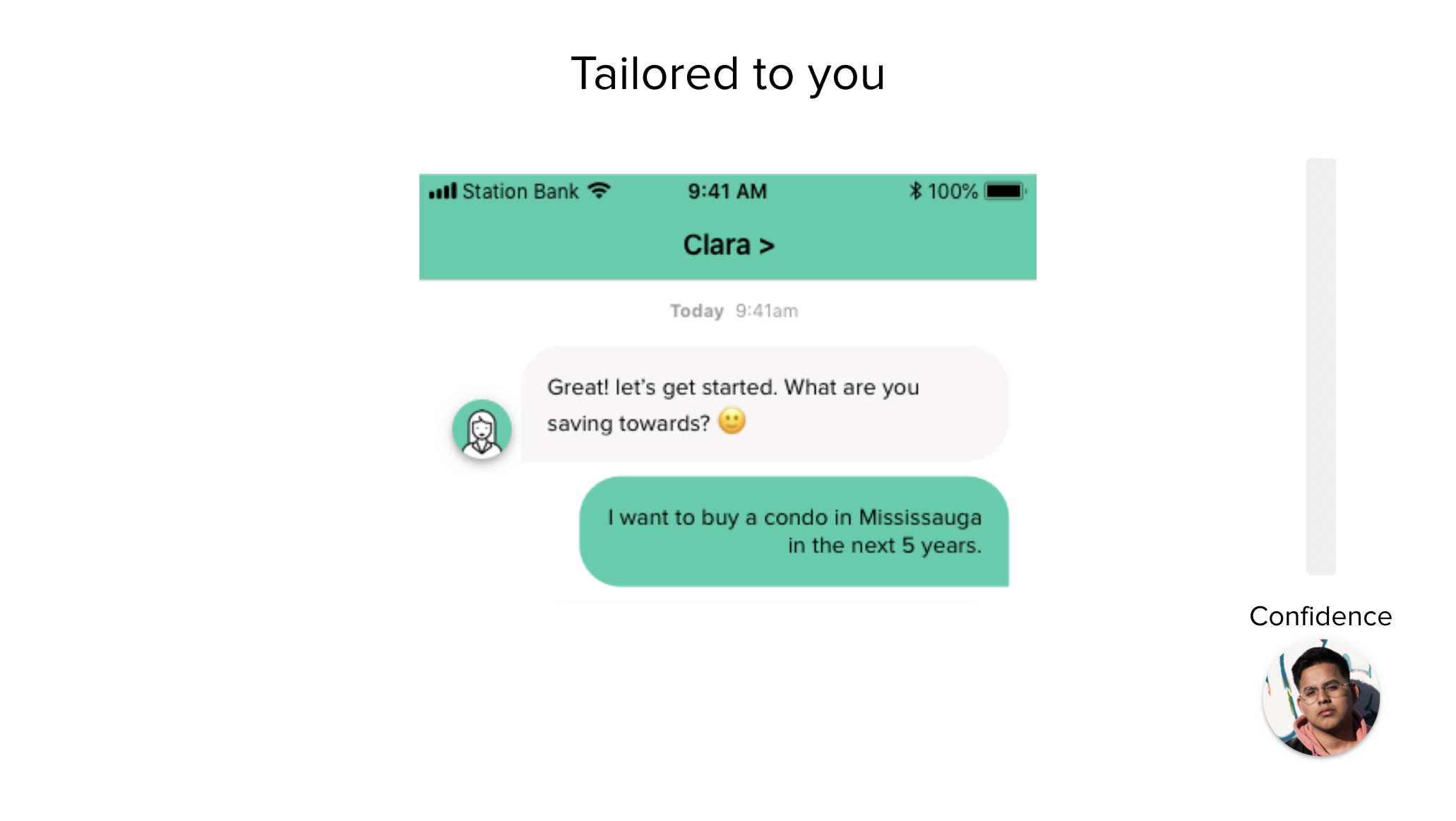

Personalization

Our research indicated that millenials perfer to talk to go to a trusted friend for financial advice. Because Henry signs in through his existing bank account Clara has access to his personal information and history. A personalized greeting and friendly language are used to make Henry feel at ease. Using Henry's transaction history, Clara can make recommendations suited to Henry's financial habits.

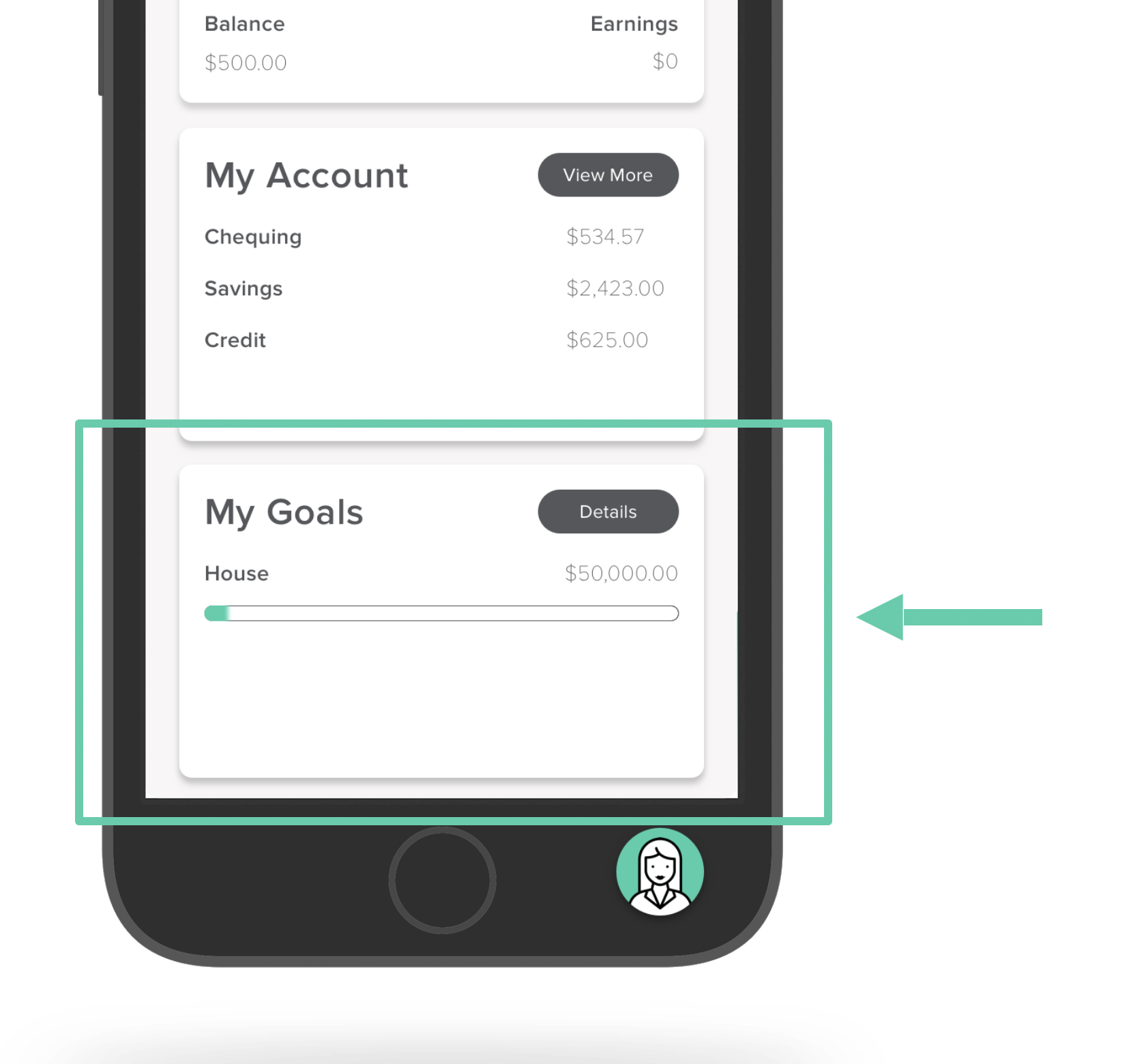

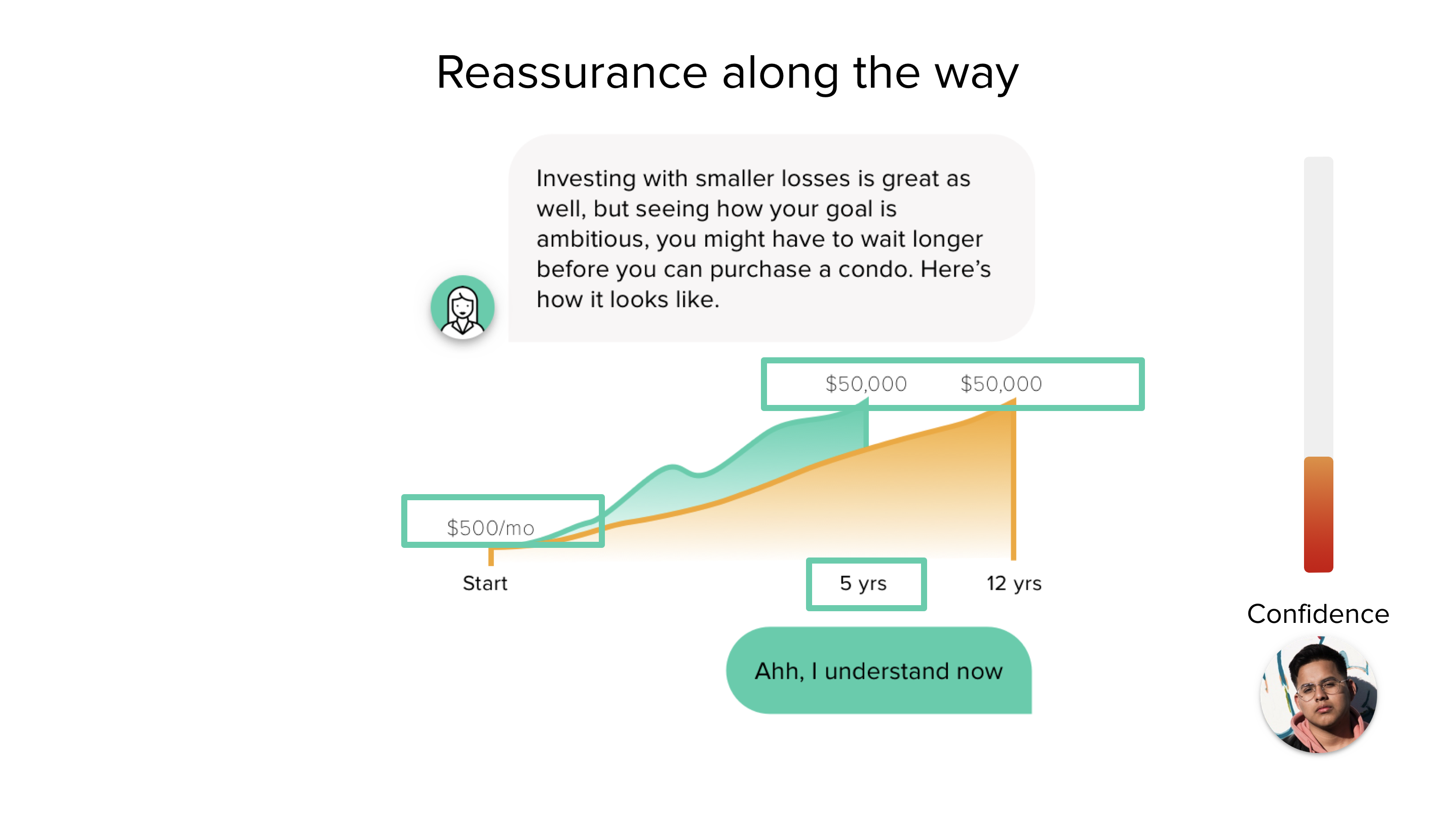

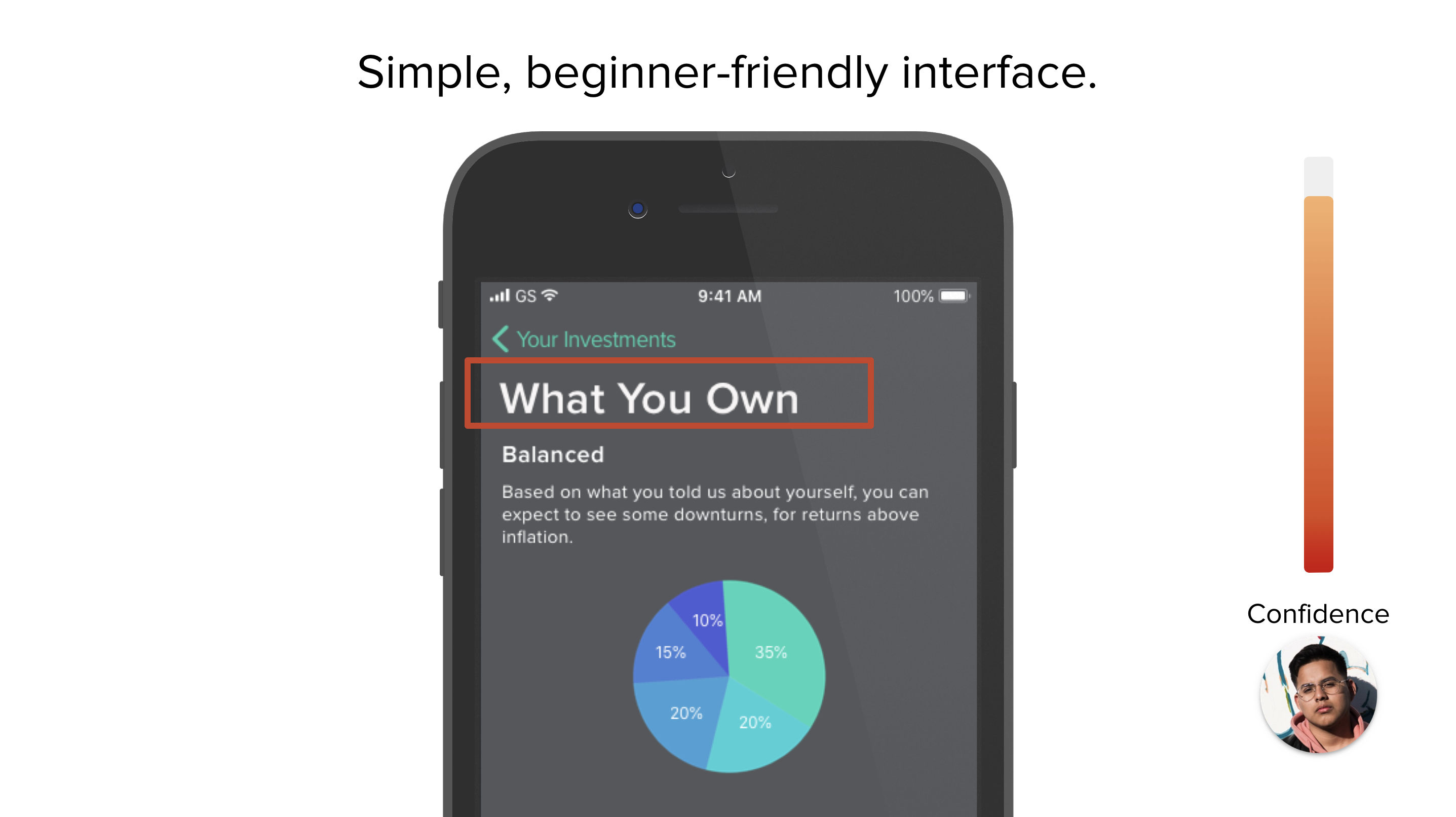

Goal- oriented

Millenials have disposable income and clear financial goals. They are interested in investing to achieve their goals but don't know where to start.

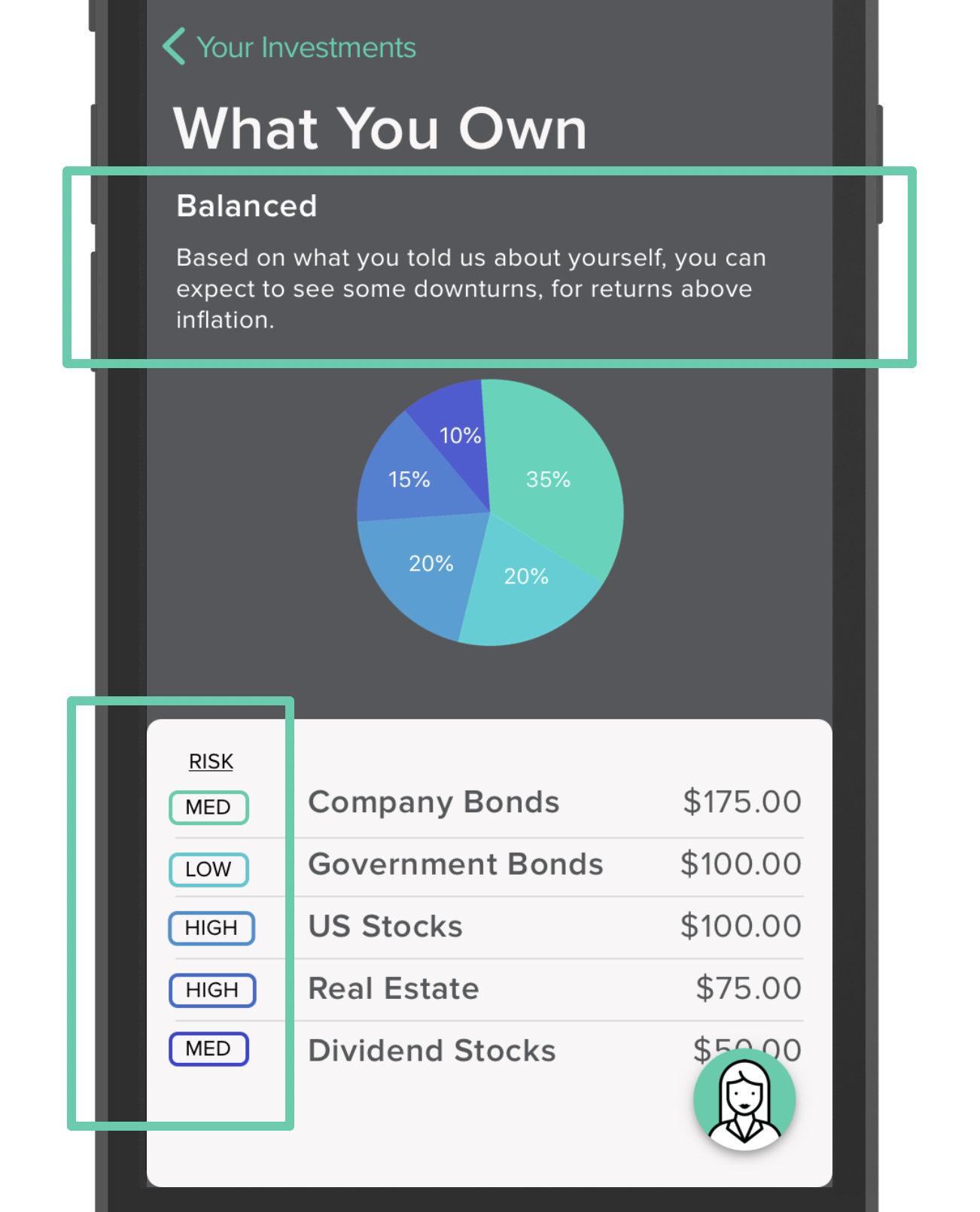

Henry knows investing can help him achieve his goals but is concerned it is too risky.Clara reassures him through detailed explanations. Henry can check the details of his portfolio along with the associated risk levels.

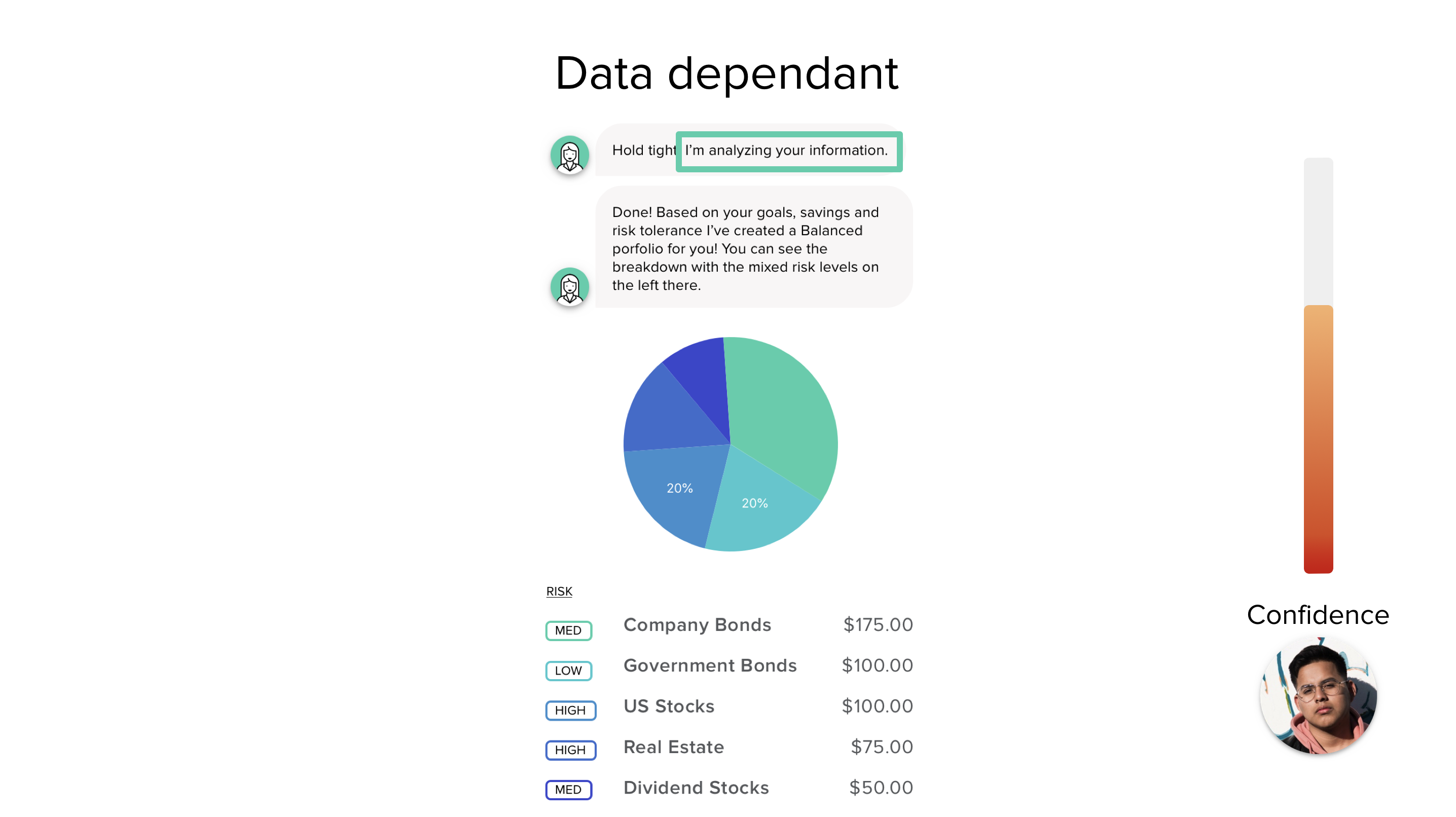

Trusted Technology

Millenials already do the majority of their banking online. Because Clara uses his data to process information, Henry feels better about Clara’s recommendation, trusting her accuracy and objectivity as a computer.

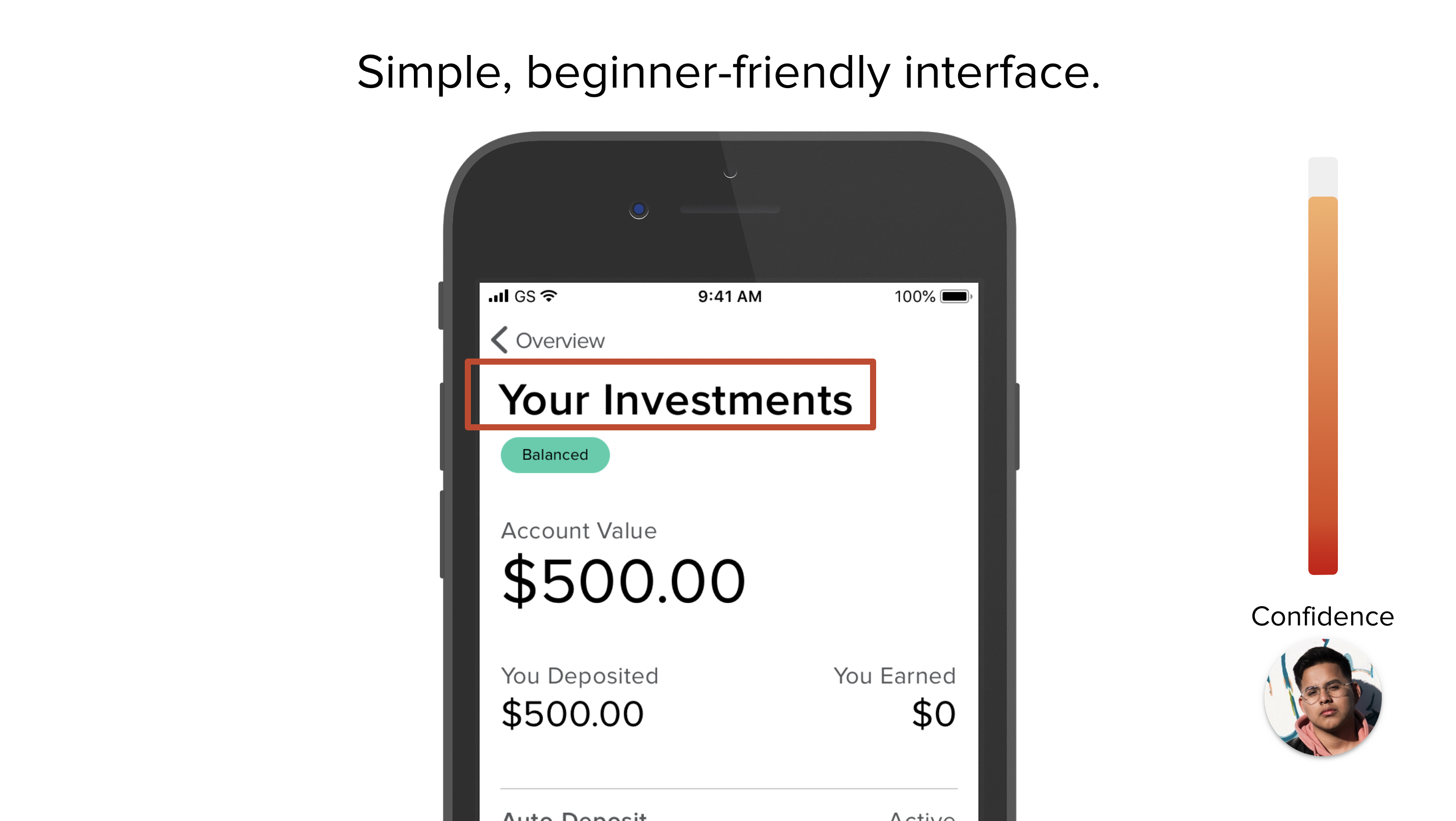

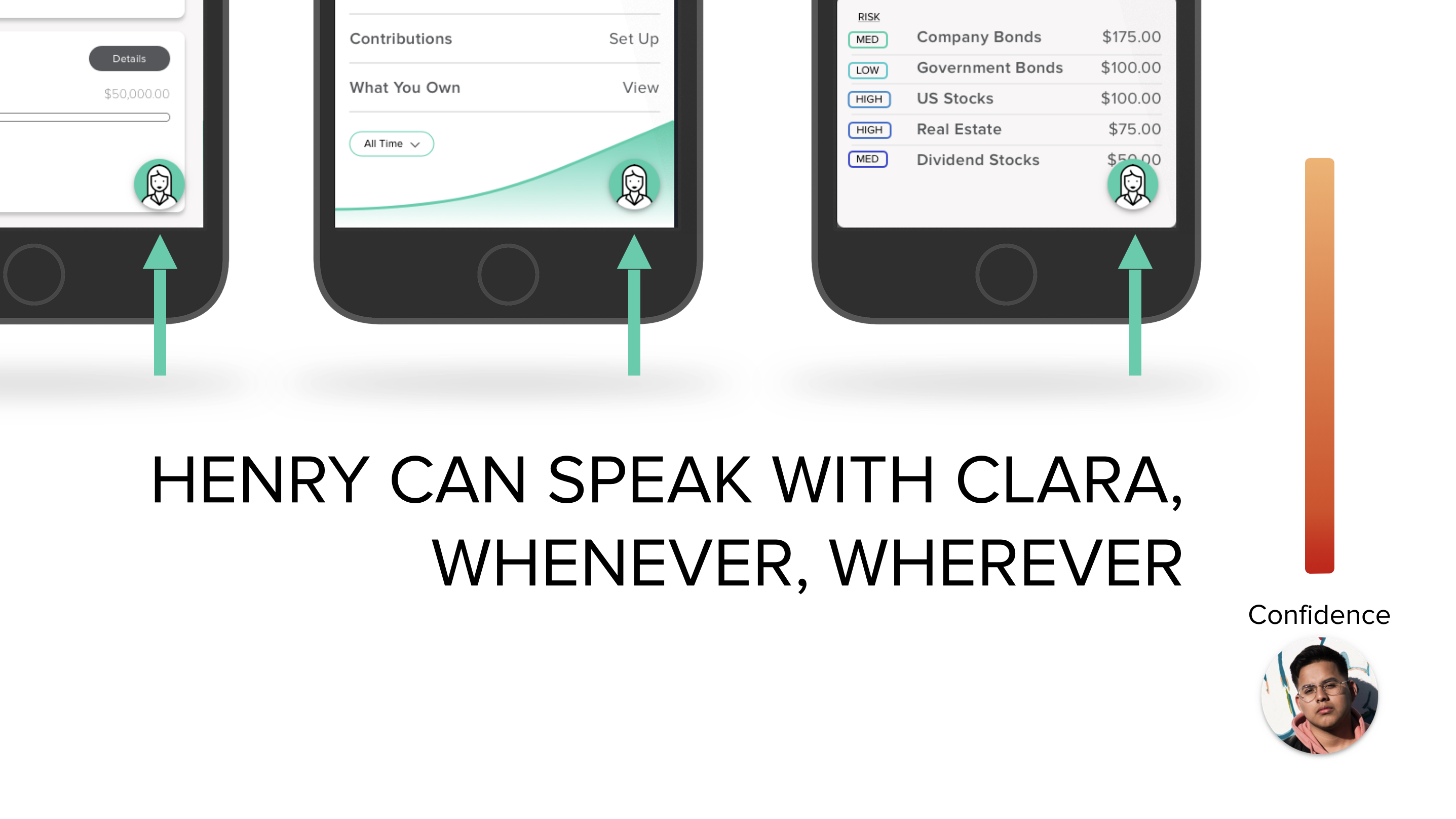

Beginner-Friendly

The interface is beginner-friendly. Financial jargon is explained using simple language. If Henry has any questions at anytime Clara is available 24/7 and on every screen for easy access.

FINAL THOUGHTS

Throughout our research and testing with the Clara prototype we were able to validate the following concepts:

- Millenials prefer a chatbot over speaking with a person

- Millenials would like to invest but need guidance

- Millenails trust computer- processed data

If the project were to continue, the next steps would be:

- Develop Clara

- Perform calculations in real time

- Have Clara help people with various levels of knowledge about investment